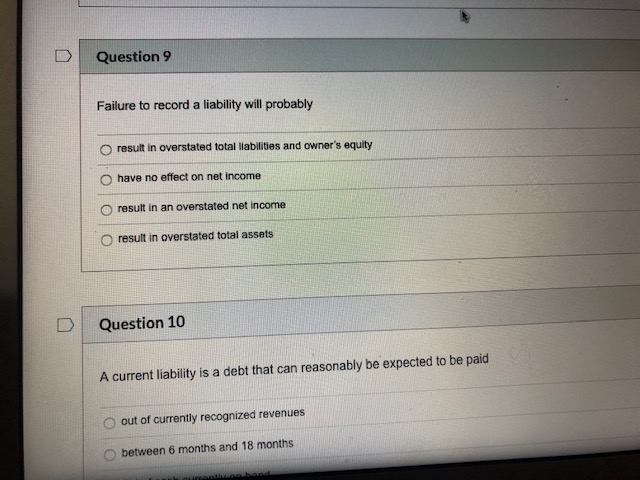

Failure to Record a Liability Will Probably

Result in overstated total liabilities and owners equity c. Chave no effect on net income.

Result in overstated net earnings.

. Result in overstated net earnings. Increase bond interest expense. D result in overstated total liabilities and shareholders equity.

Correct have no effect on net earnings 2. Result in an overstated net income. Accounts payable and receivable.

Bresult in overstated total liabilities and shareholders equity. Failure to record a liability will probably 11 Multiple Choice 3 points 002732 have no effect on net earnings. Result in overstated total assets.

Language cache disabled 2 10 10 points As interest is recorded on an interest-bearing note the Interest Expense account is. Have no effect on net income. Trout Corporation issues its bonds at a discount.

Have no effect on net income. Result in an overstated net income. The Notes Payable account is.

Failure to record a liability will probably aresult in overstated net income. A liability to be reported on the statement of financial position must have a fixed known amount to be paid in the future. Question 2 1 1 pts A current liability is a debt that can reasonably be expected to be paid __ _ _ _ _.

Failure to record a liability will probably result in an overstated net income. Question 1 1 1 pts Failure to record a liability will probably _____. Failure to record a liability will probably a.

Have no effect on net income d. Result in understated total assets. Result in understated total assets.

Result in understated total assets. Result in a overstated net income. Result in overstated owners equity.

Dresult in overstated total assets. Result in overstated net income. Amortization of the discount will.

Have no effect on net income b. Failure to record a liability will probably. Result in overstated total liabilities and owners equity.

Result in an overstated net income b. Have no effect on net income. B have no effect on net earnings.

Failure to record a liability will probably result in overstated total assets. O result in overstated total liabilities and shareholders equity. Result in overstated total liabilities and owners equity.

Dresult in overstated total assets. Result in overstated total liabilities and owners. Result in an overstated profit.

View 49docx from AUDITING 459 at Harvard University. Bresult in overstated total liabilities and shareholders equity. Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called.

Working capital Current Aseest - Current liability. Failure to record a liability will probably result in understated total assets. View the full answer.

Chave no effect on profit. Result in overstated net eamings. Question 4 1 1 pts Bonds that may be exchanged for common stock at the option of the bondholders are called ______.

Result in overstated liabilities. Have no effect on net income. 1 Failure to record a liability will probably.

Failure to record a liability will probably result in an overstated net income. Failure to record a liability probably will a. The correct answer is result in overstated net earnings Exp.

Failure to record a liability will probably a. A is correct Answer on based on equation Working capital current assets - current liabilities A is the right answer because failure to record accrued expense means liability is not entered in journal hence working capital will appreciate. Result in an overstated net income.

Failure to record a liability will probably a result in an overstated net income. Result in overstated total liabilities and shareholders equity. Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called.

Result in overstated total liabilities and stockholders equity. Failure to record a liability will probably aresult in overstated profit. Failure to record a liability will probably.

For keyboard navigation use the updown arrow keys to select an answer a result in overstated total assets. 1 10 10 points Failure to record a liability will probably have no effect on net income. Result in understated total assets.

Result in overstated total liabilities and owners equity. Result in overstated total liabilities and owners equity. Failure to record a liability will probably Select an answer and submit.

Solved D Question 9 Failure To Record A Liability Will Chegg Com

Solved Failure To Record A Liability Will Probably Result Chegg Com

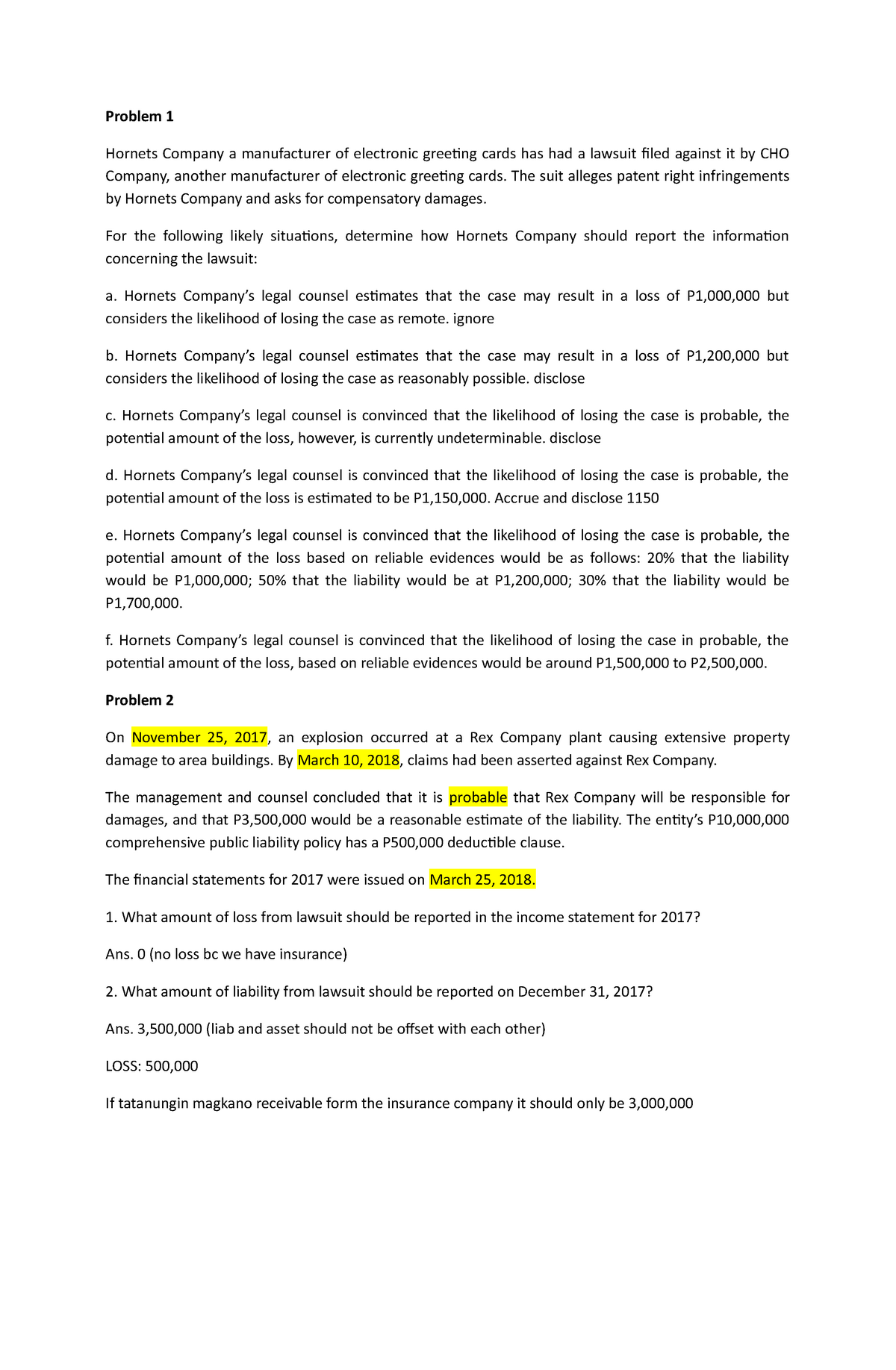

Accounting For Liabilities Part 4 Provisions And Contingent Liability Problem 1 Hornets Company A Studocu

No comments for "Failure to Record a Liability Will Probably"

Post a Comment